The fair wealth rating is based on the fair wealth evaluation system. Through the rating standards, enterprises are designated as one-, two-, three-, four- or five-star enterprises. This follows the three major themes of transparency, progress and guidance in the company evaluation.

FAIR WEALTH RATING

FAIR WEALTH RATING

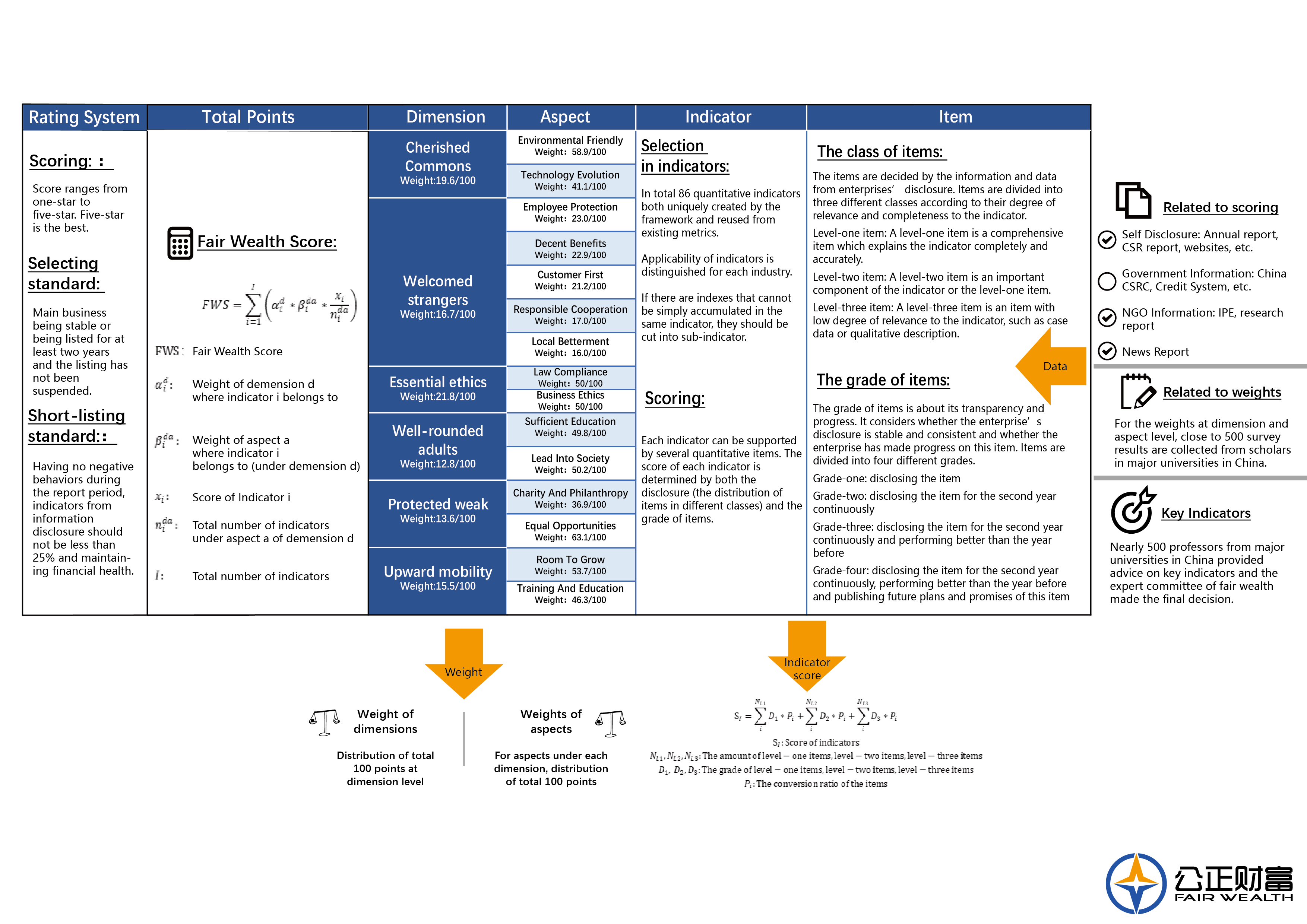

Rating System

The fair wealth rating is out of a total of five stars; the higher the star rating, the better the performance of the company.

| Score | Definition | Evaluation Standard | |||

| Total Points | Points of Six Dimensions | Key Indicators | Enterprise Spirit | ||

|

* |

Respectable |

√ |

√ |

||

|

** |

Supported when everything else being equal |

√ |

√ |

||

|

*** |

Deserving paying premiums |

√ |

√ | √ |

√ |

| **** |

Worthy of unsolicited support |

√ | √ | √ |

√ |

|

***** |

Leaders and Pioneers | Satisfying the standard for four-star enterprises and having prominent behavior that conform to the fair wealth concept and changes industry rules or business paradigms | |||

Eligibility and Screening Criteria

Eligibility Criteria

The basic eligibility criteria for the enterprise to be selected for a fair wealth rating are: the company’s main business has been sustained for at least 2 years (including being listed for 2 years or longer) and the listing has not been suspended during the rating period.

Screening Criteria

Before the enterprise rating, we conduct a basic screening of enterprises, mainly to ensure that:

- There were no major negative events during the reporting period.

- The proportion of disclosure on indicators is not less than 25%.

- There are healthy financial operations

Specifically, The major negative events refer to:

- Major environmental pollution incidents.

- Major production safety accidents.

- Major product quality events.

- Serious employee discrimination (on gender, age, region, etc.).

Healthy financial operations are measured using F-score.

The full name of F-score is Piotroski Fink score. It is a scoring mechanism with nine indicators in three principles of profitability, financial strength and operating efficiency. It will inspect and examine enterprises’ financial health based on historical data from individual financial statements. If each factor passes [the threshold), it will be given 1 point and 0 otherwise. The F-Score of enterprises ranges from 0 to 9. The higher the score, the better and healthier the basics of their financial quality are, and vice versa. Due to the different industries, enterprises need to meet the requirements on F-score performance for two consecutive years to pass the screening.

See details: